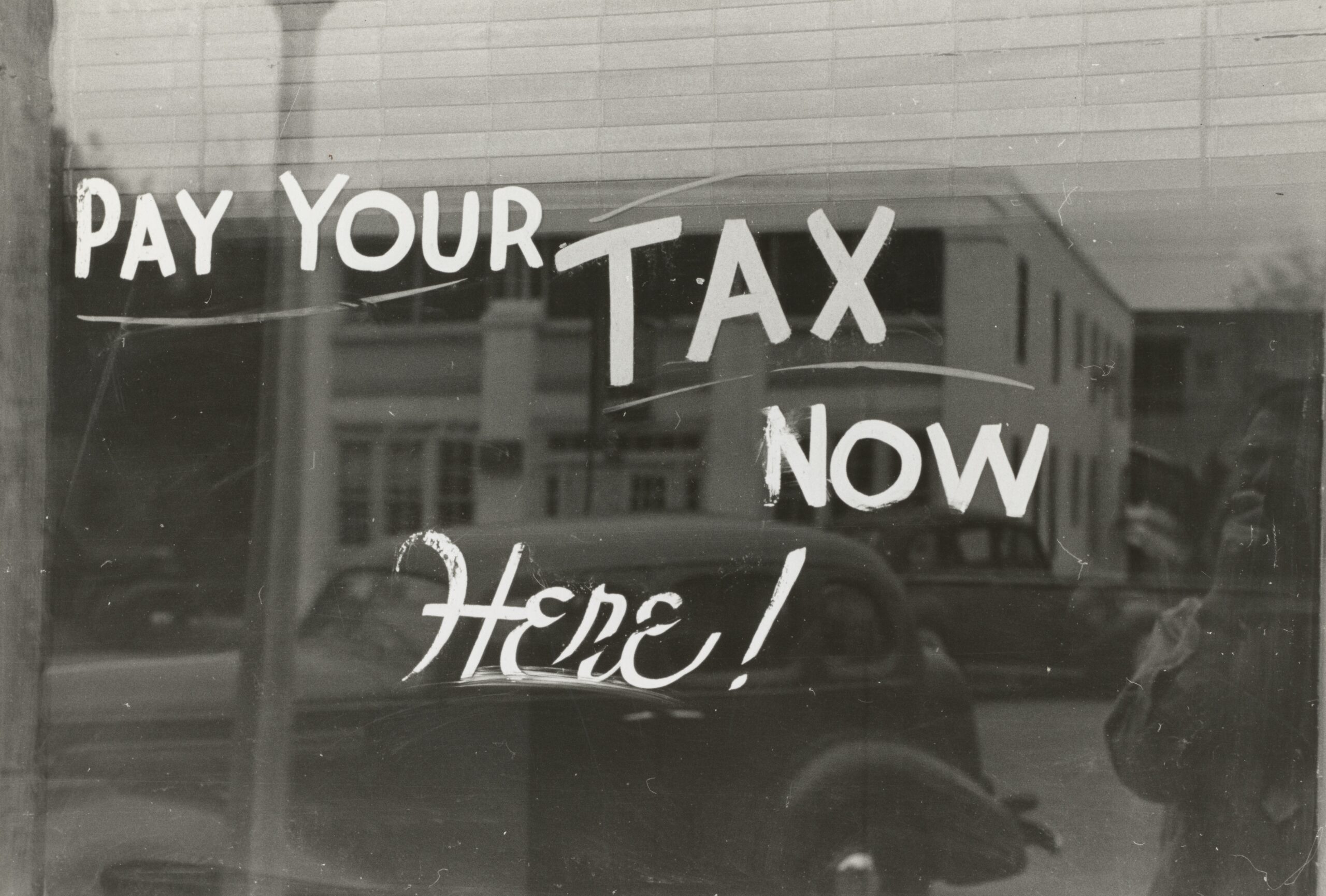

Tax season is upon us, and we must start the annual document-gathering process. For some, this is an intense process of spreadsheets and countless documents that must be analyzed. For others, it’s a simple task they complete online themselves.

Preparing our Documents

While situations will vary, preparing accurate taxes is paramount as it helps ensure you comply with the current tax codes. You can likely avoid costly penalties and interest charges through your diligent work. Moreover, thorough tax preparation can provide a current financial snapshot. This can help make informed budgeting, investment, and future planning decisions. Accurate tax preparation is essential for maintaining financial stability, avoiding legal and financial issues, and planning for the future.

What to do with my tax return?

Are you expecting a tax return this year? With increased inflation and high costs for nearly everything, deciding what to do with your return is ever so important. Below we’ll highlight some of the best options you can take.

- Start or increase your emergency fund. There is no question that an emergency fund is an essential component of a financially secure lifestyle. Nearly all of us have experienced an unforeseen expense, such as a car breakdown or a medical emergency. These unexpected expenses can derail your financial goals for months or even years if not planned for. An emergency fund provides financial protection for you and your family in a time of need. It’s all too common for individuals to resort to high-interest loans or credit cards to pay for these unforeseen expenses. While this can address the immediate issue, it can potentially put you in a difficult financial situation. Through a well-established emergency fund, you can be prepared for these unforeseen events and ultimately avoid long-term financial consequences. Depending on your situation and risk tolerance, the amount you need will vary, but a good rule of thumb is to strive for three to six months of savings.

- Pay down credit card debt. Credit card debt can be a dangerous and long-lasting challenge for many people’s financial well-being. Most credit cards carry high-interest rates; if you carry a balance month after month, you’ll pay a lot in interest. By paying off or at least lowering your balance, you can free up money from those pesky monthly payments and redirect those funds to savings or other financial goals. Another reason to pay down your debt is that carrying large balances can negatively impact your credit score, which can affect you the next time you apply for a car loan or mortgage. Lowering or eliminating your credit card debt can put you on a solid financial footing and closer to your financial goals.

- Retirement savings. It’s never too early to save for retirement, and 2023 is no different. As many understand, saving for retirement is essential for achieving financial security, and it’s typically a process that takes decades. An influx of money from a tax return is a perfect opportunity to invest in your future by putting these funds into a retirement account. Ideally, you can regularly contribute to retirement accounts, such as 401(k) plans or IRAs, which allows you to take advantage of compound interest, enabling your savings to grow exponentially over time. The price of living is continuously increasing, and when it comes time to retire, you will want to ensure you have enough funds to cover your basic expenses, such as housing and healthcare. Take advantage of your return and max out your IRA or 401(k) this year.