As many of us saw, it was another rollercoaster in the stock market this week. Stocks did end higher on Friday, which could be a small silver lining. Sadly, most people saw higher gas prices this week, with the national average hitting $4.47, according to AAA. This is over a ten-cent jump from a week ago, and diesel is averaging $5.56, which is over a $2.00 hike from a year ago. It’s clear that higher gas prices are cutting into everyone’s budget like never before. It was announced back in March that the U.S. would be releasing 30 million barrels of crude oil in an effort to lessen the impact of rising. We’re still feeling the increased prices eating into our pockets nearly two months later.

Inflation continues to be a critical topic for the U.S. economy and the rising costs for everyday people. The Federal Reserve has already increased rates, but we can expect the Chair of the Federal Reserve, Jerome Powell, to increase the rate further this summer to curb inflation. Powell has stated they are monitoring the economy closely, and the Fed will meet in June (14-15) and July (26-27), where we can likely expect another rate increase. This will mean the cost to borrow money will increase again, and loans for mortgages and cars will be higher.

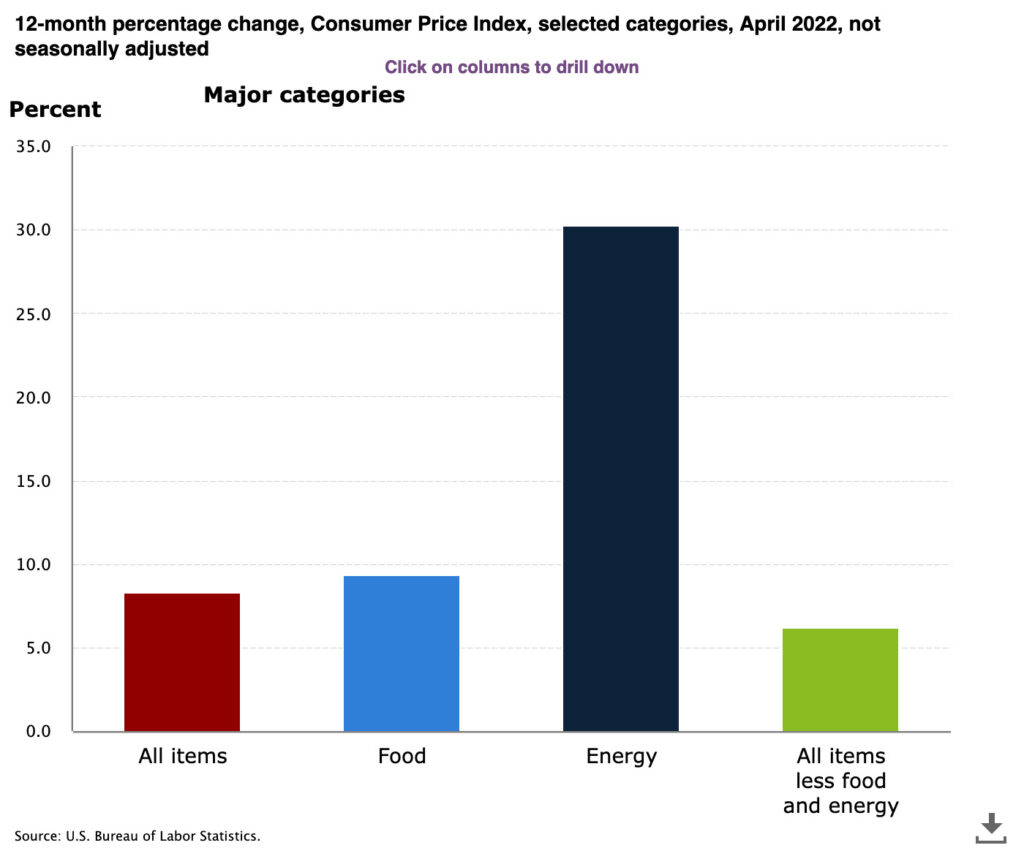

According to the U.S. Bureau of Labor Statistics, the Consumer Price Index (CPI) for all urban consumers rose 0.3 percent. The CPI measures the average change over time in prices by consumers on goods and services. As I’ve mentioned already, everyone is paying higher prices for nearly everything. On top of that, many businesses are still experiencing staff and labor shortages, which was highlighted by a significant shortage of baby formula in parts of the country.

As we approach Memorial weekend and millions of people hit the road for travel, expect to pay high gas prices and generally higher costs for your long weekend vacation to start the summer off. While expenses will be high, remember to take time for yourself and the family. There isn’t anything you can do to stop rising gas prices, but as long as you incorporate the increased expenses into your monthly budget and do not overextend, you should be ok.