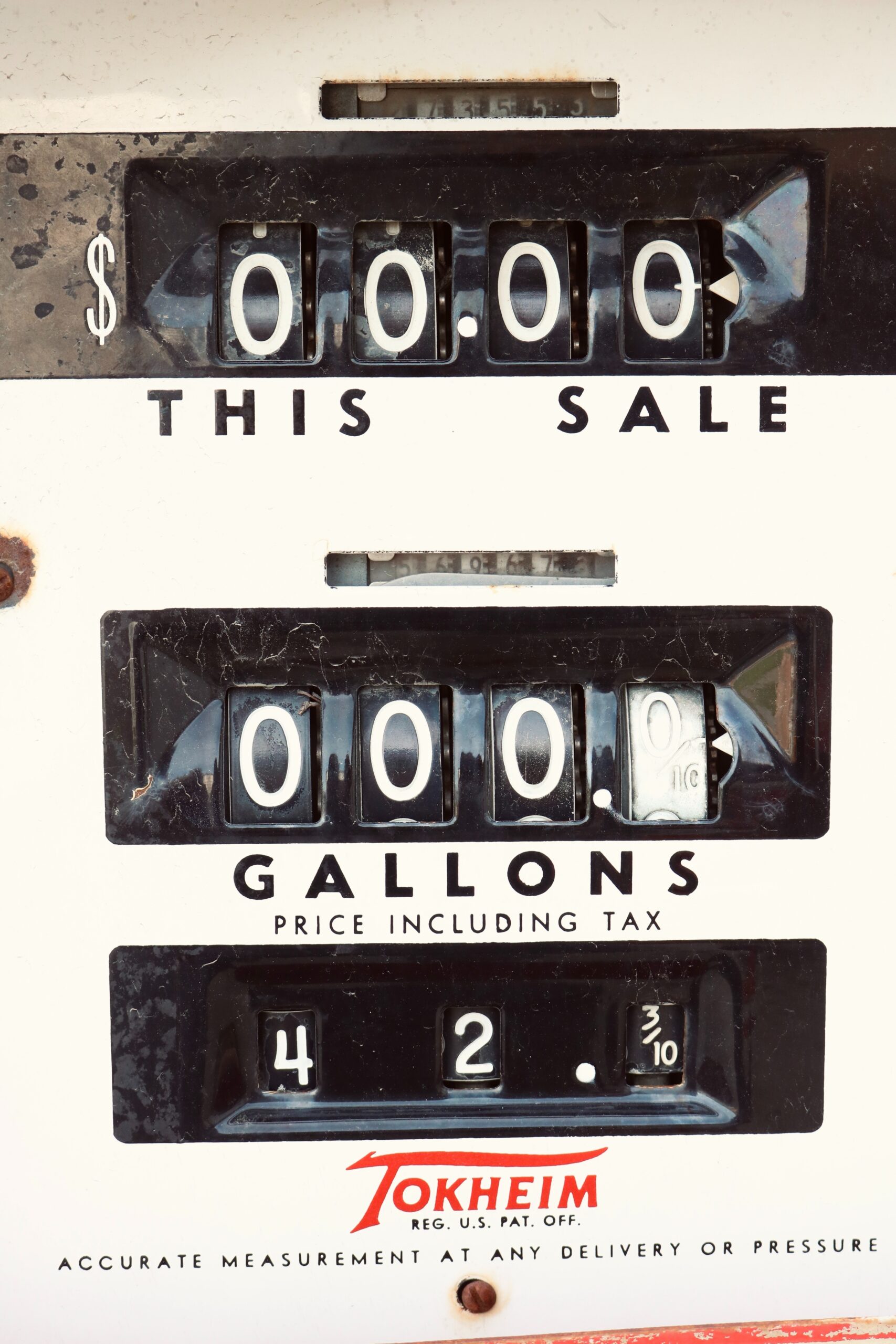

The holiday weekend is finally here, and the unofficial start of summer has begun. It’s estimated that millions of people will fly or hit the road this weekend despite record-high gas prices. The AAA national average hit a new record today of $4.61, up over $1.50 from a year ago. While everyone enjoys the long weekend, it’s clear it’ll cost more than in previous years. Everything costs more, from the meat you’re putting on the grill to the fruit tray.

This week it’s not all bad news as the stock market showed some positive gains to end the week. Most stocks have been getting battered for the past two weeks, so it was good to see a couple of days in the positive territory. Looking into next week, Amazon will be splitting its stock on June 3rd. While it doesn’t change the company’s valuation, it may be an opportunity to pick up some shares if you’ve been interested in the company but couldn’t overcome the $2,000 per share price. There’s still no official word on a Tesla stock split that was discussed back in March. The Tesla board was considering a split, but nothing has been decided. If approved could provide a similar opportunity for inventors looking to get a piece of the electric vehicle market. Electric vehicles (EVs) are gaining massive popularity this year as the country experiences record-high gas prices, and Tesla currently maintains approximately 75% of the EV market.

Additionally, the current administration has made it clear that EVs are a priority and lowering the dependence on fossil fuels. It will be interesting to see if the White House takes any steps toward incentivizing the purchasing of EVs going forward. Still, I wouldn’t expect anything soon as high gas prices will likely be enough incentive for people to make the switch. Suppose you’re interested in EVs but don’t want to invest in a single manufacturer. In that case, you can also look at investing in EV batteries or component companies that may supply multiple manufacturers. If you’re interested in the EV sector, check back for my article on ways to invest.

As mentioned last week, the housing market appears to be cooling for most of the country. According to the National Association of Realtors, home sales declined nearly 4% in April, a decline for the sixth consecutive month. As we’re experiencing the most significant jump in interest rates in the past twenty years, we can likely expect the market to continue down this path. Moreover, rates will likely increase again by the end of the summer as the Federal Reserve strives to control inflation. Despite the slowing housing market, prices remain high and inventory low, so the cost of ownership will remain a significant hurdle for most, especially in the near term.

Enjoy your Memorial Weekend!